The latest AAII Sentiment Survey again indicates extraordinary reactivity to price.

Last week, the major equity indices pulled back a bit with the S&P 500 losing 1.3% (intraday high to low), the $DJIA a little over .5%, the Nasdaq 2% & the Russell 2000 a little more than 3%.

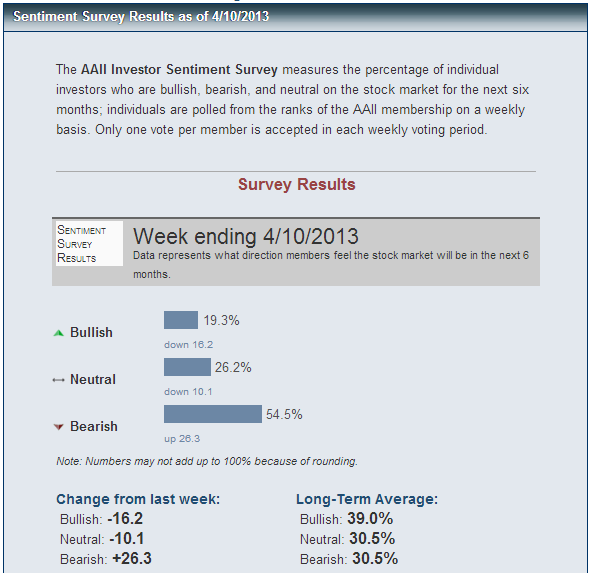

In response to this shallow correction, however, the sentiment survey shows a huge spike in bearish sentiment of +26.3% from 28.2% to 54.5% while bullish sentiment decreased 16.2% to 19.3%.

While I have been writing and speaking extensively about the high sentiment reactivity for a while now and how it bouys equity prices, I am still surprised by the extremity of it evident in these numbers.

In an environment where sentiment shifts so much on such modest declines, the shift acts like a put or hedge against lower prices. Individual investors are an emotional wreck and it is astonishingly bullish.

Note: For all the latest on the AAII numbers and analysis I highly recommend following Charles Rotblut on StockTwits. He is a VP at AAII, does a great job covering the numbers and much more and he will answer your questions insightfully on the stream.

Related:

Behavioral Finance and the Freudian: An Interview with StockTwits’ Phil Pearlman

$SPY $IWM $DIA $QQQ

Pingback: Putting Investor Bearish Sentiment into Context | The Big Picture()