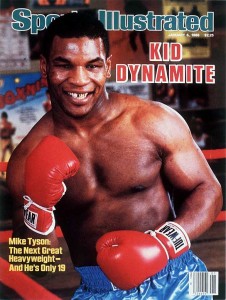

Everybody has a plan until they get punched in the face

– Mike Tyson

Its been more than 30 years since Kahneman & Tversky validated man’s innate propensity to be irrationally loss averse.

Its been more than 30 years since Kahneman & Tversky validated man’s innate propensity to be irrationally loss averse.

And since then, thousands of studies have been conducted that detail every way people act which leads to unnecessary draw downs.

(We avoid loss realization, we take mental shortcuts, we get over confident, we neglect information that runs counter to our thesis… etc etc.)

Yet markets remain irrational and investors continue to behave in ways that run counter to their own best interests. Our new understanding has done little good and this will continue as long as humans are involved in markets and no matter how much empirical knowledge we gain regarding our limitations.

Computerized (and HFT) trading, which has come to dominate daily volume, will not save us as we have seen as there are people behind the curtain who must construct the algorithms, enable the computers and ultimately assume the risk.

Even on the level of economic policy it is no different. Some of the smartest minds in the world appear ill equipped to make decisions which serve long term best interests as leaders around the world also tend to “kick the can” in order to avoid experiencing the pain associated with losses in the present.

Truth is, understanding our own limitations and intellectualization does little to curb irrational behavior.

Only real world experience and a propensity to learn new responses to uncomfortable situations can enable a process by which traders can successfully navigate markets.

The taste of one’s own blood after getting punched in the face…

A small percentage of traders will learn over time from their own mistakes and will begin to act counter to their own hard wired and detrimental impulses.

There’s only one path to curbing the tendencies and it doesnt come from learning about why we do stupid things with money especially when we are losing.

It comes from stepping in the ring, getting knocked down and then getting up again…

***

If you are a student or faculty up in the Boston area, please join us on May 8th at The StockTwits Symposium at Harvard University: Trading in the Wild. I will be discussing trading psychology and preparing for battle in the ring and will be joined by a group of super smart and experienced investors including Josh Brown, Todd Sullivan and JC Parets.

It should be excellent. There are only a few spots remaining and you can sign up HERE

(ht: AnneMarieTrades who hit me with that great Mike Tyson quote some time ago.)

Pingback: Friday links: how to scale | Abnormal Returns()

Pingback: Breakfast Links | Points and Figures()