This is a post about how a system responds to extreme stress. In this case the system is the US equity markets and the stressor is the 9/11 attacks…

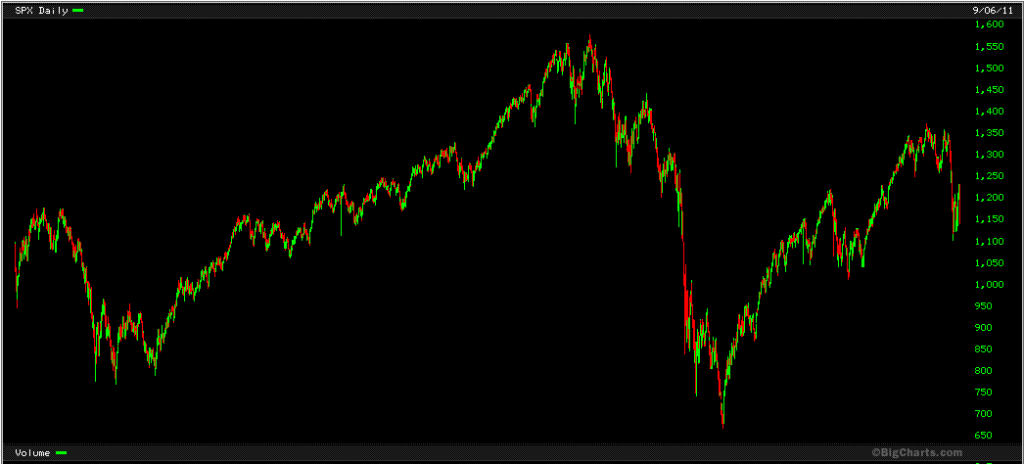

On September 10, 2001, the day before the attacks, the SP500 ($SPX, $SPY) closed at 1092 down 435 points or 28% from the March 2000 high above 1500 while the NASDAQ Composite closed down 3350 points or 66% from its March 2000 high.

It was clear to all but the last believers that the NASDAQ ($QQQ) bubble had burst and that the wealth effects created by the inflation of the internet bubble had been lost by all but those who’d sold their stocks much earlier.

The Federal Reserve had begun dealing with the steep and rapid economic and market downturn by lowering rates and loosening monetary policy.

An article titled Fear of Recession Ignites Discussion of More Tax Cuts appeared on the 10th in the New York Times and read:

Administration officials said the president had not decided to back any particular proposal. They said he believed that previous steps, including the tax cut he signed in June, should spark a recovery before long. If it does not, they said, he might eventually seek further actions.

It is critical to examine the environment and the state of the market at the time it is exposed to an extreme stress such as the 09/11 attacks, because how it responds is directly affected by these factors. Further, the manner in which it responds quickly gets habituated and hence more and more difficult to alter over time. It becomes ensconced in the response whether it is helpful or not.

If a market is strong and well supported, it will respond with more resilience and recover more quickly. It will cope more adaptively with the stressor.

But, if a market is already weakened and lacking support, it will not possess the resources to cope as effectively and will cling to and habituate maladaptive coping strategies.

Since September 10, 2001, the SP500 has risen a mere 6.6% (well under 1% annualized). And for all of that sideways action it has been a hell of a rollercoaster. The $SPX fell another 300+ points after 9/11 to 770, doubled from there to 1560, dropped by more than 50% to 670, doubled again to 1370 and more recently has fallen back yet again to yesterday’s close at 1165.

That’s a lot of risk for so little return over a ten year period.

Before the attacks, the US was already relying too much on monetary policy and rates to deal with economic problems. These were already our drugs of choice. The extreme stress caused by the attacks and the subsequent anthrax scare served to increase our vulnerability and the collective perception of urgency to self medicate rather than adapt reinforcing the feedback loop.

It is little wonder that we continue to rely on similar remedies today, ten years later, despite continued evidence that such measures are not in our nation’s long term economic interests.

The stress of the 9/11 attacks continues to act as one significant casual factor of this maladaptation.

Pingback: Hot Links: The Tip Off | The Reformed Broker()

Pingback: Wednesday links: quantifying hits | Abnormal Returns()