Last week, the S&P 500 fell 1.06% to 1691.42 from the all time high close the week before of 1709.67.

Hardly a rout.

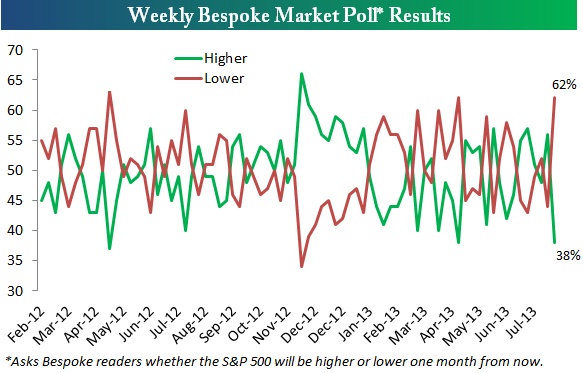

Yet, on this week’s Bespoke Sentiment Poll, bearishness hit a 2013 high with 62% of respondents seeing a lower $SPX one month out and 38% seeing higher. The week before, the reading stood at 56% bulls to 44% bears so there was a one week 18% increase in near term gloom.

This type of reflexive steep spike in bearishness has occurred all year on even the shallowest of dips and I have been writing and speaking about the phenomenon in detail since March. From my point of view, this is nothing less than the ingrained character of the collective market participant.

Two things matter here: 1) Traders and investors are innately anxious and get scared on the first sign of weakness and 2) These bearish spikes signal premature washouts and act like an index put, actually buoying the market and muting steeper declines.

Sure, we can get a larger correction and even take out the critical 1670’ish support on the S&P’s, but this is not how bull markets end.

$SPX $SPY

Leave a Reply