Its so very nice when all your indicators line up perfectly.

It would be splendid if the market was showing signs of topping while sentiment was super bullish. Many times, though, we face discrepancies and the markets are not so obliging.

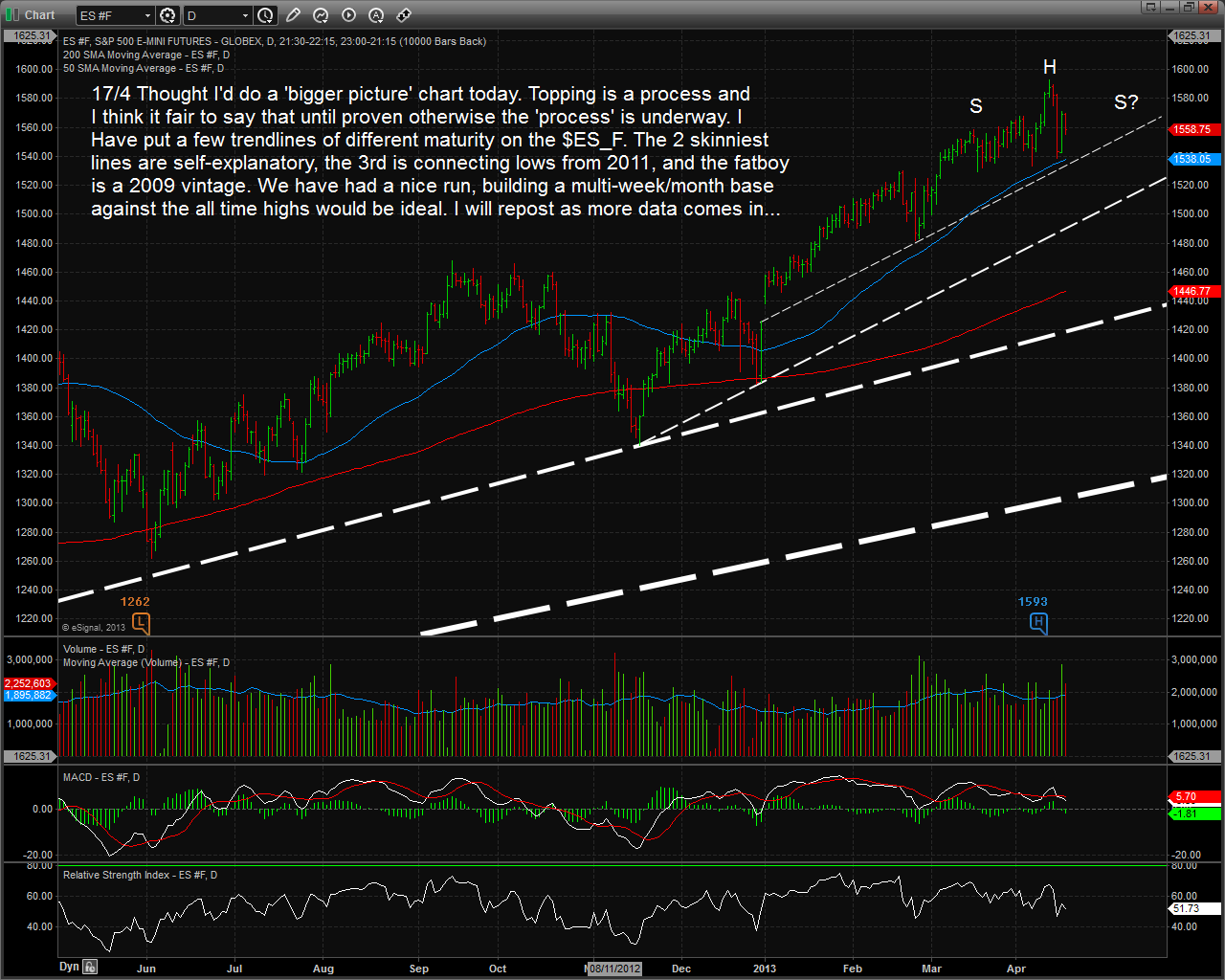

Here’s @wisedom’s chart from this morning that nicely shows, technically, where we are if the market is indeed in the process of topping.

I have been and remain in waiting for the correction mode (see my post Waiting for Godot) so I’m relieved to finally see it looking as if one is shaping up.

It has not been comfortable as the $SPX made all time highs and looked as if it would test or maybe even blow through 1600 sooner rather than later but now the scenario suggests topping and seasonals are also becoming more favorable as sell in May approaches.

So great, commodities are breaking down too and it looks like we will get some fat weekly bearish candles in the major indices come Friday and maybe more damage before traders shift into looking for a bottom mode.

However, I have also been focusing ad nauseam on the very high level of bearish sentiment reactivity and how bullish this has been and potentially remains. What I mean here is that every time the market sinks even a bit, everyone gets very negative very quickly and these episodes look and respond like a bearish sentiment extreme or capitulation that is bullish stocks.

So I am left with apparently opposing signals that are key to how I formulate my market thesis:

1. Price behavior suggesting a corrective process.

2. Sentiment suggesting even shallow dips will be bought.

Rather than interpreting the mixed signals dichotomously, I am taking a dialectic path and attempting to resolve at least to some degree.

The key element for me in synthesis is just sitting with the mixed signals, waiting and watching the events play out with all the imperfections no matter how uncomfortable it might be at times. Its just the gray reality at this moment.

Patience.

One last point – it looks to me as if a lot of traders are anticipating the $SPX top in general and the head and shoulders pattern in particular and I recall prior incidences in which very highly anticipated h&s patterns gave false signals and the market continued to rip.

$SPY $QQQ $XLE

Leave a Reply