Price and earnings momentum go together like rhythm and melody. Some of the best stocks you will ever find have a combination of both and the stocks can go a lot farther than most would imagine.

Some of the small and mid caps that are not at the forefront of media attention can be great plays especially if the economy recovers and analysts are faced with chasing estimates to catch up with increasing projections.

The StockTwits50 and the StockTwits Charts streams are great places to find candidates but of course you must do the research of earnings x price momentum plays for yourself.

Stamps.com ($STMP) has been discussed at length on both for a while now and so is not unfamiliar to StockTwits members but there is still a world of investors out there who have never heard of the name.

$STMP is a company that recently reported that has both. It is under the radar with a market cap below 500m and average daily volume below 500k.

Earnings Momentum (The Melody): Earnings momentum is like a stock’s melody. It tells the story.

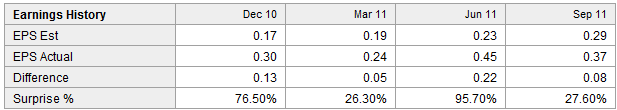

Below is a table with the earnings history relative to analysts estimates for $STMP including the most recent quarter reported Thursday. You will notice that the company is not only growing the bottom line but also handily beating analyst consensus estimates. The beat is key because analysts are only very slow to catch up to a story even as their projections remain a proxy of market expectations.

Analysts still have a bunch of catching up to do which could take another 2-4 quarters.

Price Momentum (The Rhythm): Price momentum is like a stock’s rhythm or as BAD once chanted, its demonic charge.

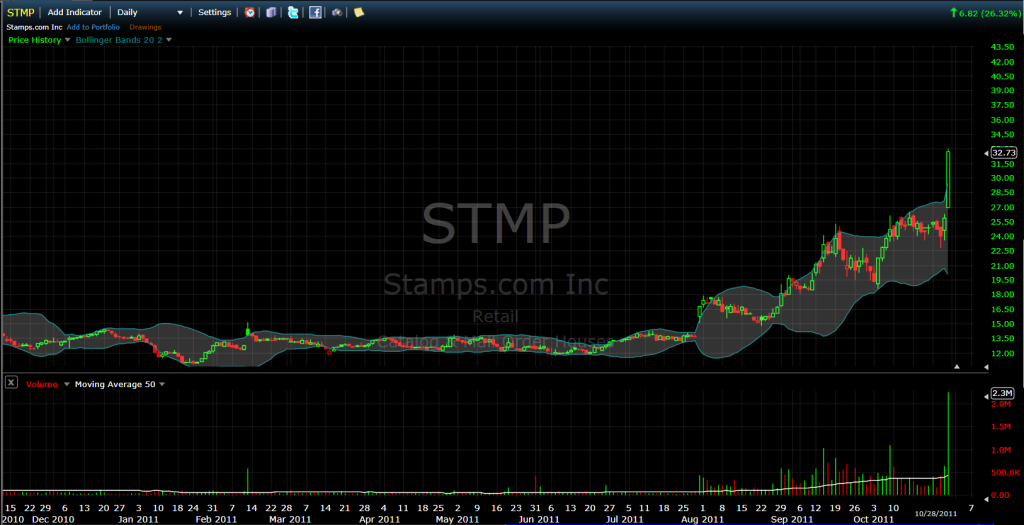

Well, it doesn’t take Charles Dow to tell you that $STMP is ramping. The chart below tells the tale:

Interest Momentum (The Harmony): The music to momentum analog would not be quite complete without a discussion of a stock’s harmony or interest momentum. When interest in a stock is also accelerating, then you have a growing market awareness of the stock rising and potentially more buyers.

Interest momentum is not as easy to measure as earnings or price momentum but volume gives some indication. Note how volume in $STMP began increasing significantly after the last earnings announcement in late July (see the above price chart).

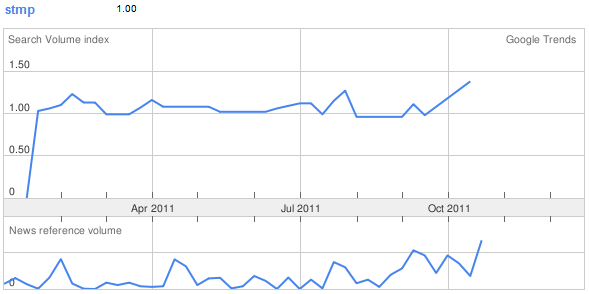

One might also check out Google Trends in order to glean a bit about search volume and news references:

The point of this post is not to recommend $STMP although I think it needs to be on your watch list and another round of healthy consolidation here might beget more buying soon enough.

Its more to highlight how one might integrate earnings, price and interest momentum in order to identify stocks that can make you a lot of money if you buy them well, trade around the position and utilize options to manage risk and hang in there for multiple earnings reports.

If economic recovery is setting in, then there will be a number of these gems where analysts estimates have not caught up to fundamental reality.

Leave a Reply