Something to keep in mind kids…

Its impossible to precisely measure market sentiment.

Compare it to measuring market behavior.

There is only one way to measure market behavior but we can do that with total precision. Look at a chart and we know the high, low and close over multiple time frames and also the exact amount of that behavior or volume.

Now, lets think about sentiment for a moment.

We have multiple ways to purportedly measure it (put/call, $VIX, AAII, anecdote etc) and yet none of these methods are precise. Sentiment is an internal process and even one individual can only inexactly verbalize a feeling much less tens of thousands of individuals. There are construct limitations too as all of these measures are not actually measuring sentiment itself but only a shadow of it (implied volatility etc).

I bring this up based on two noteworthy yet opposing data points published today.

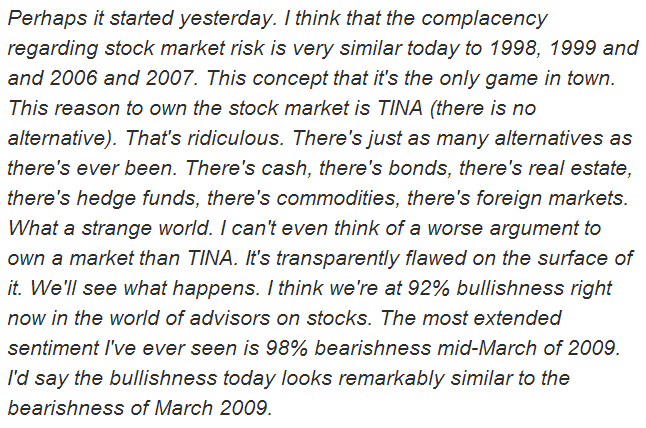

First, here’s a quote from the brilliant Jeff Gundlach:

This is Jeff’s appraisal of market sentiment and he views it as complacent.

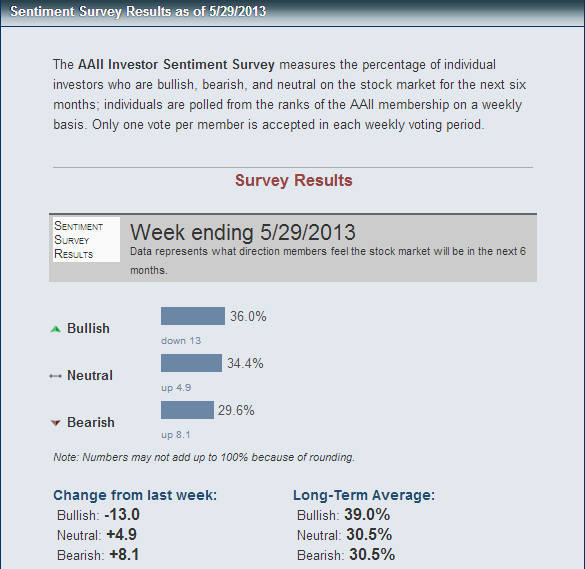

Next, here is this morning’s AAII Sentiment Survey Numbers:

These numbers show below historical average bullishness despite the continued rally in US equity indices.

There’s value in every observation or measure depending upon how it is incorporated just be aware that sentiment observations both qualitative and quantitative are only indirect observations, inexact and distorted by multiple factors.

ht: Doug Kass for the Gundlach quote